Stop the auto insurance scam

Ever since the 2019 auto insurance reforms, a majority of Michiganders have chosen to keep their unlimited Personal Injury Protection (PIP) benefits, which should pay for all necessary care for the rest of their lives, should they get into a serious car crash.

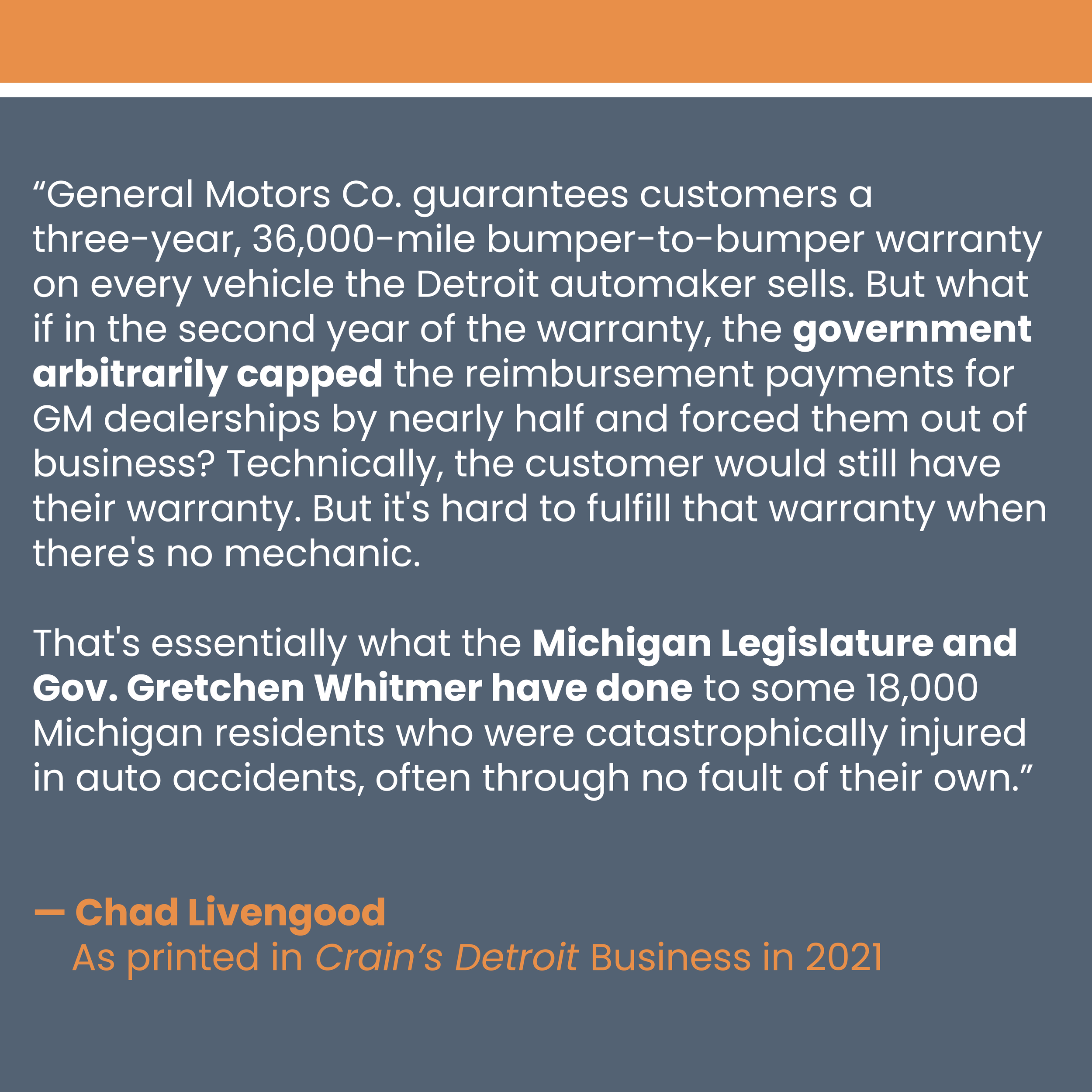

But because of the nearly 50% cut in catastrophic care included in the new law, those benefits have become effectively worthless—and insurance companies are cashing in on the scam.

Keep reading to learn more about what can be done.

The 2019 reforms have been a mixed bag for consumers. One provision gave drivers the ability to choose their preferred Personal Injury Protection (PIP) benefits, which pay for medical bills and lost wages in the event of a serious auto crash. Consumers are also benefitting from a fraud authority, utilization review, and other elements of the new law.

However, the 2019 reforms also included a nearly 50% cut in reimbursements for post-acute care services, including residential rehabilitation, in-home nursing and health care aides, case management, community-based programs and transportation services.

This cut has led to Michigan’s ongoing crisis in care, which has directly caused the deaths of several catastrophically injured Michigan residents—who were living happy and productive lives prior to the implementation of the cut—as well as the discharge of more than 7,000 patients, the loss of more than 4,000 health care jobs, and closure of dozens of businesses.

The post-acute care industry has been decimated. Crash survivors can’t find anyone who can afford to take care of them. The businesses that have survived simply can’t accept any new patients, because the new reimbursement level is far less than the cost to render services.

That means that insurance companies are essentially selling junk policies—and consumers are left holding the bag.

Meanwhile, the Michigan Department of Insurance and Financial Services—which is tasked with regulating the state’s insurance companies—has done nothing to stand up for consumers. In fact, DIFS is advocating against efforts to end Michigan’s care crisis and restore access to care for all consumers, claiming that premiums would increase.

The truth? DIFS just approved a $1.35 BILLION increase in auto insurance premiums from 2022. According to the September 2023 report from Insurify, Michigan still has the highest premiums in the nation.

Those dollars are going straight from consumers’ pockets to the bonuses of insurance company CEOs. A recent report from the Consumer Federation of America found that “six of the major insurance company CEOs each received over twelve million dollars in compensation in 2022, and in total, these ten insurance executives were paid over $130 million in 2022.”

Michigan drivers are paying exorbitant rates—and we’re getting nothing for it. It’s a scam.

What can be done? The solution is passing Senate Bills 530, 531 and 575—a narrow fix that would end the state’s crisis in care and restore access to post-acute services by creating a reasonable and sustainable fee schedule that must be honored by insurance companies when paying post-acute rehabilitative care providers.

Proponents of these bills are fighting to protect all Michigan consumers. Opponents are protecting the billion-dollar insurance companies and allowing them to sell junk policies.

Stop the auto insurance scam. Pass Senate Bills 530, 531 and 575.